How Compound Interest Investments Can Help You Achieve Financial Success

Compound interest investments can be a great way to achieve financial success. By investing a fixed sum of money at regular intervals, you can allow your investment to grow over time through the power of compound interest. This can provide you with a secure and consistent stream of income in retirement, helping you to maintain your standard of living even in difficult economic times. If you’re looking for a way to ensure your financial security, consider investing in compound interest vehicles today.

The best compound interest investments

There are many different types of compound interest investments available, but some of the most popular include:

- Savings accounts are one of the safest and most popular options for compound interest investments. Many banks and credit unions offer savings accounts with competitive interest rates.

- Certificates of deposit are another safe option for earning compound interest. These deposits typically have slightly higher interest rates than savings accounts, but they also have stricter withdrawal rules.

- Money market accounts often have higher interest rates than savings or checking accounts. They may also offer check-writing privileges and ATM access.

- Treasury securities are backed by the full faith and credit of the United States government and offer a safe investment option. These securities can be purchased through banks, brokerages, and the U.S. Treasury itself.

- Corporate bonds are debt securities issued by corporations. They typically offer higher interest rates than government bonds, but they also carry more risk.

- Mutual funds are investment vehicles that pool money from many investors and invest it in a variety of assets, including stocks, bonds, and cash equivalents. Many mutual fund companies offer target-date funds, which automatically adjust the mix of investments as the investor gets closer to retirement age.

- Exchange-traded funds are similar to mutual funds, but they are traded on stock exchanges like individual stocks. ETFs often have lower fees than mutual funds, and they offer a more convenient way to invest in a variety of assets.

- Real estate investment trusts are companies that own and manage income-producing real estate properties. REITs often offer high dividend yields and can be a good option for investors looking for income.

- Commodities are natural resources such as precious metals, oil, and agricultural products. They can be bought and sold on commodity exchanges, and some investors believe that commodities offer a hedge against inflation.

- Collectibles are items such as art, coins, and stamps that are typically purchased for investment purposes. They can be difficult to value, and they may not generate any income.

Which compound interest investment is right for you will depend on your individual goals and circumstances. You should always consult with a financial advisor before making any investment decisions.

The ins and outs of compound interest investments

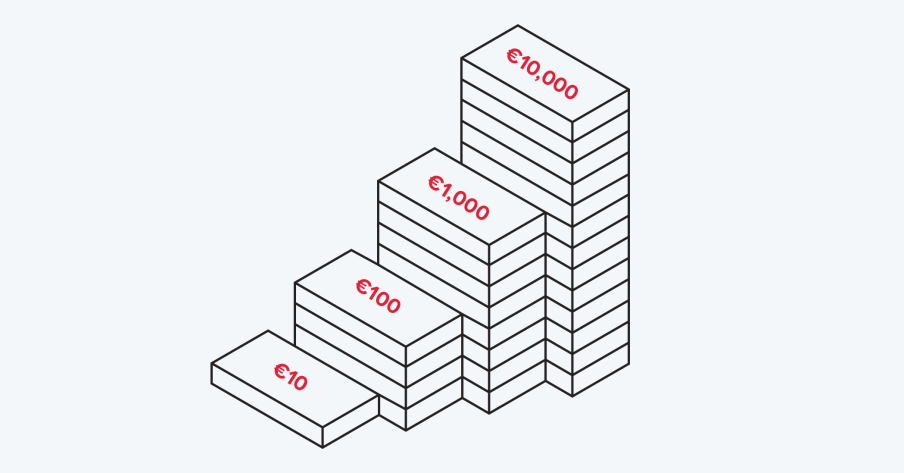

To start compound interest investing, you’ll need to open a savings account or investment account that offers this feature. Many banks and credit unions offer these accounts, so shop around to find the best rate. Once you’ve opened an account, you can start making regular deposits. The more you deposit, the faster your money will grow.

You can also use compound interest to grow your retirement savings. For example, if you have a 401(k) or IRA, you may be able to invest in a mutual fund that offers this feature. This way, your money will grow tax-deferred until you retire.

Finally, don’t forget to keep an eye on the fees your bank or financial institution charges. For example, some places charge monthly maintenance fees, while others may require a minimum balance before they start compounding your interest. Be sure to ask about these charges before you open an account, so you’re not surprised later on.

With some research and patience, you can start reaping the benefits of compound interest investments. This investment can be a great way to grow your money over time, providing you with a nest egg for retirement or other future goals.